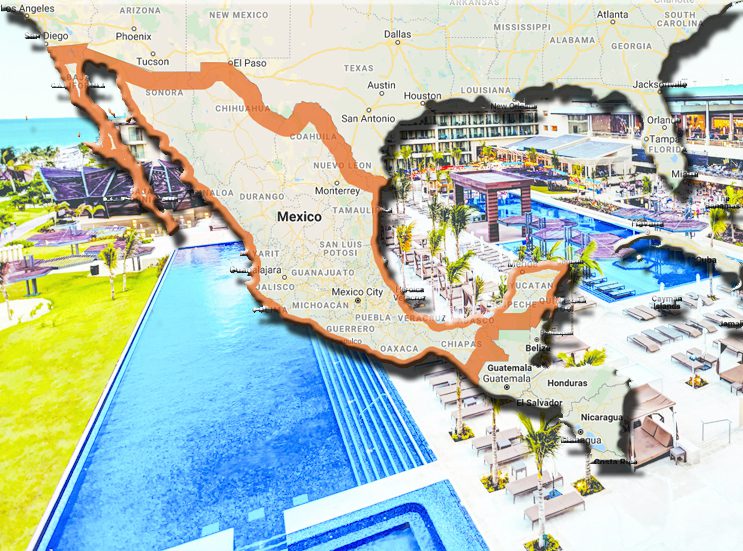

The Restricted Zone

Property Acquisition within the Zone

“We are defined

by our bonds and

not our borders”

As set forth within Article 27 of the Mexican Constitution, “no foreigner shall be allowed to acquire direct title to land within the ‘restricted zone’ which is defined as all land located within 100 kilometers of any national border and within 50 kilometers of any sea or ocean”. For Americans, that’s about 62 and 31 miles respectively. However, as of 1994, changes to Mexico’s Foreign Investment Law began allowing foreigners to acquire both direct and indirect title to land in the Restricted Zone via either 1) a Mexican corporation or 2) a bank trust, popularly referred to as a “Fideicomiso”.

As set forth within Article 27 of the Mexican Constitution, “no foreigner shall be allowed to acquire direct title to land within the ‘restricted zone’ which is defined as all land located within 100 kilometers of any national border and within 50 kilometers of any sea or ocean”. For Americans, that’s about 62 and 31 miles respectively. However, as of 1994, changes to Mexico’s Foreign Investment Law began allowing foreigners to acquire both direct and indirect title to land in the Restricted Zone via either 1) a Mexican corporation or 2) a bank trust, popularly referred to as a “Fideicomiso”.

-Zona Prohibída

More than a million and a half expats now own and enjoy life on their property south of the border and have done so since the country changed its Foreign Investment Law or “FIL” in the early ’90s. Realizing that securing their borders and coastline against invading armies as had been their concern and policy for over 400-years was no longer necessary, and that tourism and foreign investment were the future for the country, Mexico softened it’s stance on foreign ownership within the Constitutionally-restricted “Zona Prohibida” which is land within 62-miles of the borders and 31-miles of their coastline; and in doing so, opened up some of the most beautiful beachfront property in the world to American and other foreign ownership. But the country didn’t completely abandon its national control of that property by requiring that, while Mexican citizens have no restrictions on ownership, foreign individuals must hold ownership of their land in a bank trust, a practice not that much different from other countries including the United States.

More than a million and a half expats now own and enjoy life on their property south of the border and have done so since the country changed its Foreign Investment Law or “FIL” in the early ’90s. Realizing that securing their borders and coastline against invading armies as had been their concern and policy for over 400-years was no longer necessary, and that tourism and foreign investment were the future for the country, Mexico softened it’s stance on foreign ownership within the Constitutionally-restricted “Zona Prohibida” which is land within 62-miles of the borders and 31-miles of their coastline; and in doing so, opened up some of the most beautiful beachfront property in the world to American and other foreign ownership. But the country didn’t completely abandon its national control of that property by requiring that, while Mexican citizens have no restrictions on ownership, foreign individuals must hold ownership of their land in a bank trust, a practice not that much different from other countries including the United States.

–Mexican Corporations

While the vast majority of investors in Mexico’s coastal property without commercial business interests prefer to simplify the acquisition process and do so as a private individual employing the fideicomiso as the vehicle, for about 30-years now and with restrictions, foreigners have also been able to fully own, operate and administer Mexican corporations; corporations which require a minimum of only two associates or shareholders, both of which can be foreigners as in husband and wife, brothers, etc. However as most of these restrictions are relative to activities in which a Mexican corporation can participate with foreigners involved in such businesses as mining, airports and telecommunications, there are no such investment restrictions on foreign-owned Mexican corporations when engaged in real estate acquisition. And, as an informational aside to this fact, the Richardson Law Manual is an excellent source for the layman.

While the vast majority of investors in Mexico’s coastal property without commercial business interests prefer to simplify the acquisition process and do so as a private individual employing the fideicomiso as the vehicle, for about 30-years now and with restrictions, foreigners have also been able to fully own, operate and administer Mexican corporations; corporations which require a minimum of only two associates or shareholders, both of which can be foreigners as in husband and wife, brothers, etc. However as most of these restrictions are relative to activities in which a Mexican corporation can participate with foreigners involved in such businesses as mining, airports and telecommunications, there are no such investment restrictions on foreign-owned Mexican corporations when engaged in real estate acquisition. And, as an informational aside to this fact, the Richardson Law Manual is an excellent source for the layman.

Of the many different types of Mexican corporations that exist, the two most common are the S.A. de C.V. and the S. de R.L. de C.V. Requiring only two shareholders, both of whom can be American, the S.A. de C.V. is similar to the American limited liability corporation or LLC with the S. de R.L. de C.V. closely resembling an American LLP or limited liability partnership.

As in the US, selecting which type of corporation to create is both unique to the individual’s needs and of the utmost importance for tax purposes. That said, investors considering this type of acquisition vehicle should speak with an attorney and/or an accountant well-versed in foreign property law and finance to be advised accordingly. These practices are extremely specialized because of the ever-changing Mexican regulations and typically well-outside the expertise of most local real estate agents.

–Tax Notes

For those investors wishing to employ the Fideicomiso as tha vehicle to ownership rather than a corporation, historically, the IRS has maintained a position that a Fideicomiso is a foreign trust meaning the American owner of real property, through a Fideicomiso arrangement, had to file Form 3520 and Form 3520-A and that failing to do so created a significant US tax penalty of 25% of the money you “contributed” to this “foreign trust”; in other words, 25% of the purchase price of the property. Arguing the unfairness of the statute, Austin, Texas-based counsel Amy Jetel applied for and received a PLR or Private Letter Ruling from the IRS articulating their position that the Fideicomiso was really a nominee arrangement and not a trust and, through our former firm The AmesGroup, we joined in the argument submitting an Amicus Curiae or “Friend of the Court” brief arguing that the Mexican bank that owns the property for the investor through his or her Fideicomiso arrangement statutorily behaves more like a nominee than a trustee opining, “A trustee of a trust has a special duty to safeguard property for the benefit of a specified people. In a fideicomiso contract, the bank explicitly disavows any responsibility for anything whatsoever and is specifically enjoined from acting individually without the express direction of the Fideicomisar”.

In response to the arguments it received, the IRS issued Revenue Ruling 2013-14 (PDF); a document that states the government’s re-defined position as applicable to all taxpayers, not just the represented which rescinds the 25% levy on individuals purchasing property in Mexico as well as a tremendous amount of risk and paperwork for Americans with property acquisition aspirations in Mexico. Typically, a PLR applies only to the taxpayer who obtains it so, plainly stated, this changed the fiscal game for many investors .

-Beware the Master Trust

In 1997, Mexico changed its banking system and subscribed to the International Banking Standards or “IBS” leaving only one Mexican-owned Bank in the country. The others are foreign-owned by different international banks including Citi Bank and Chase.

It is within these banks that the fideicomisos reside and while people speak of the fideicomiso as if it were a single entity, it is not. It can be offered either through a Master or Individual Trust with the latter being the preferred method because the beneficiary (investor/buyer) maintains complete control over the trust to buy, sell or mortgage, encumber, will or inherit it and the property it as he or she sees fit.

Of particular interest to investors researching individual condominiums or homes on parcels of land that are part of a larger, overall development, is the fact that these typically involve a master trust which could be compromised with a lien or default by the developer for non-payment of taxes or failure to pay workers or suppliers. In a Master Trust, the developer is responsible for the payment of taxes and then apportions them for reimbursement to each fideicomiso/property owner held under the Master Trust. In an Individual fideicomiso, the beneficiary (investor/buyer) is responsible for payment of their own taxes. Therefore, a non-payment by one property owner would not affect another property holder in the development. For this reason, most, if not all banks are now only issuing Individual Trust fideicomisos and will no longer approve Master Trust fideicomisos.

Be well-advised though, that your fideicomiso specifically prohibits you from engaging the protection of a foreign government (USA) with respect to any Mexican land dispute that may arise. This is called the “long-arm clause” and not internationally uncommon as the US has similar protections in place compelling US jurisdiction over US property when foreign citizens bring suit.

Perhaps the most important part of property acquisition in Mexico is making absolutely certain that the developer has him- or herself completed the subdivision process or “fraccionamiente”. Whether Mexican or American owned, each development must complete the this process before individual parcels can be offered for sale to investors. This is especially inportant where the investor is a foreigner. If you do not have a fideicomiso through an authorized bank, then at best you have a lease and a lease is not an estate ownership. Any other form of “ownership” such as share of a corporation, squatting the property (yes, people still try that!), owning with a Mexican national partner or any other “trick of the trade”, and there are many, to circumvent the law, can have severe repercussions. Not even Mexican citizens are permitted to own property in a subdivision unless the development is properly documented and subdivided; just as in the United States, whether it’s one lot or a thousand, in the eyes of the government, whenever a parcel is “subdivided”, it must go through the subdivision process.